Introduction to financial management

- 1. Introduction to Financial Management Financial Management Srinivas Methuku

- 2. Money itself is neither created nor destroyed, its simply transferred from one perception to another.

- 5. What is Finance??? • Finance is the art & science of managing 'MONEY'. • Finance is the life blood of Business (funds). • “Finance v/s Money”

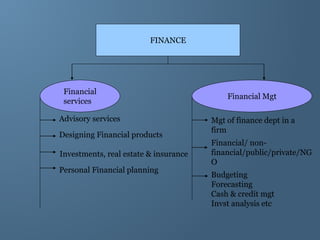

- 6. FINANCE Financial services Financial Mgt Advisory services Designing Financial products Investments, real estate & insurance Personal Financial planning Mgt of finance dept in a firm Financial/ non- financial/public/private/NG O Budgeting Forecasting Cash & credit mgt Invst analysis etc

- 7. Financial Management • According to Ezra Solamn “Financial management is concerned with the efficient use of an important economic resources viz capital funds”. • Financial Management means planning, organizing, directing and controlling the financial activities such as procurement and utilization of funds of the enterprise.

- 8. Meaning: Financial Management • Financial Management is an operational activity, which is accountable for the effective utilization of funds necessary for operations. One of the primary objectives of financial management is to maintain enough money to meet the necessary current and capital expenditure, apart from maximizing profits.

- 9. Nature of Financial Management Financial management is mainly concerned with the proper management of funds. The financial manager must see that the funds are procured in a manner that there is risk, cost and control considerations are properly balanced in a given situation and there is optimum utilization of funds.

- 10. Financial Management Process • Assess Current Financial Position • Define and Prioritizing Goals • Financial and Investment Plan • Implementation of the Plan • Monitor, Evaluate and Adjust Performance

- 11. Scope of Financial Management • Scope covers both acquisition & utilisation of funds – efficient and wise allocation of funds to various uses. • Financial mgt involves providing solutions for major financial operations of a firm - Investment decisions - Financing decisions - Dividend policy decisions

- 12. Investment decision/ function • Investment decisions relates to the selection of assets (fixed & current assets) in which funds will be invested by a firm. • Invst in fixed & long term assets & projects is called capital budgeting – volume of invst , risk & returns , cost of capital. • Invst & mgt of current assets is called working capital mgt –mgt of cash, inventory & receivables, profitabilty & liquidity.

- 13. Financing Decision / Function • Financing decisions are concerned with the Capital structure decisions of a firm ( proportion of debt & equity). • Creating proper mix between debt & equity – optimum capital structure. • Tradeoff between risk & return.

- 14. Dividend policy decisions / functions • Deciding the Dividend payout ratio considering the benefit of shareholders & firm both. • Dividend decision should be analysed in relation to the financing decisions of the firm.

- 15. Duties / Roles / Responsibilities of a Financial manager • Performing Financial Analysis • Making Investment decisions • Making Financing decisions

- 16. Performing financial analysis & planning • Transforming financing data into form which can be used for decision making. • Determing need for additional (reducing) finance.

- 17. Making investment decisions • Determine the mix of current assets & fixed assets to be held by a firm. • Determine the type of asset in each category

- 18. Making Financing decisions • Determining mix of short term & long term financing. • Indepth analysis of available financing alternatives , their costs & long term implications.

- 19. Risk Return Trade-Off • Amount of Return = Amount of Risk Undertaken • Amt X of Loss is more Epochal than Amt X of Gain • Risk Averse Instrument have High Demand Raising the Price and Lowering the Returns. • Risk Premium is the Higher Return gained over Risk Free Returns.

- 20. Emerging / Changing role of Finance managers in India • Post liberalisation the role of finance manager has become more important, complex & demanding. • Industrial licensing abolished and scope of private sector investment has increased. • Abolition of MRTP • Abolition of Capital issues control act – freedom in designing and issuing securities.

- 21. • Market determined interest rate and exchange rate volatality. • Globalisation, FDI. • Investors have become more demanding and assertive.

- 22. Challenges for Financial Managers in a Changing Economic Environment • Regulations • Globalization • Technology • Risk • Transformation • Stakeholders Management • Strategy • Reporting • Talent and Capability

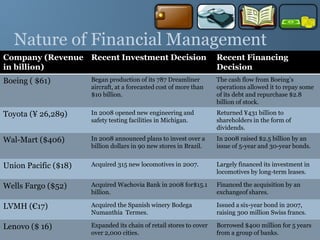

- 23. Nature of Financial Management Company (Revenue in billion) Recent Investment Decision Recent Financing Decision Boeing ( $61) Began production of its 787 Dreamliner aircraft, at a forecasted cost of more than $10 billion. The cash flow from Boeing’s operations allowed it to repay some of its debt and repurchase $2.8 billion of stock. Toyota (¥ 26,289) In 2008 opened new engineering and safety testing facilities in Michigan. Returned ¥431 billion to shareholders in the form of dividends. Wal-Mart ($406) In 2008 announced plans to invest over a billion dollars in 90 new stores in Brazil. In 2008 raised $2.5 billion by an issue of 5-year and 30-year bonds. Union Pacific ($18) Acquired 315 new locomotives in 2007. Largely financed its investment in locomotives by long-term leases. Wells Fargo ($52) Acquired Wachovia Bank in 2008 for$15.1 billion. Financed the acquisition by an exchangeof shares. LVMH (€17) Acquired the Spanish winery Bodega Numanthia Termes. Issued a six-year bond in 2007, raising 300 million Swiss francs. Lenovo ($ 16) Expanded its chain of retail stores to cover over 2,000 cities. Borrowed $400 million for 5 years from a group of banks.

- 24. Finance function • Finance function involves the task of procurement of funds needed by the enterprise and its effective utilization.

- 25. Organisation of Finance function

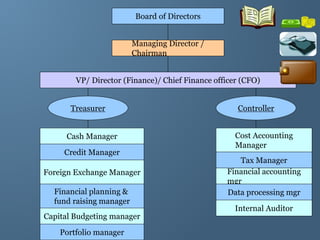

- 26. Board of Directors Managing Director / Chairman VP/ Director (Finance)/ Chief Finance officer (CFO) Treasurer Controller Cash Manager Credit Manager Foreign Exchange Manager Financial planning & fund raising manager Capital Budgeting manager Portfolio manager Cost Accounting Manager Tax Manager Financial accounting mgr Data processing mgr Internal Auditor

- 27. Functions of a Treasurer • Treasurer is mainly responsible for financing & Investment activities. • The main functions of a treasurer are - Obtaining finance - Investor relationship - short term financing - cash & credit mgt - Investments & insurance

- 28. Functions of a Controller • Controller is concerned with Accounting & Control. • The main functions of a Controller are - Financial Accounting - Internal audit - Taxation - Management accounting & control - Budgeting & planning

- 29. Objectives of financial Management a. Financial objectives b. Non-Financial Objectives

- 30. Financial objectives or Financial Goals Profit maximization (profit after tax) Maximizing EPS(earnings Per Share) Wealth Maximization.

- 31. Profit Maximization Maximizing the Rupee Income of Firm Resources are efficiently utilized Appropriate measure of firm performance Serves interest of society also

- 32. Objections to Profit Maximization • It is Vague • It Ignores the Timing of Returns • It Ignores Quality of benefits

- 33. Shareholders’ Wealth Maximization • Maximizes the net present value. • Fundamental objective — maximize the market value of the firm’s shares

- 34. Maximizing EPS • Ignores timing and risk of the expected benefit. • Maximizing EPS will not result in highest price for company's shares.

- 35. Non financial Objectives General welfare of employees General welfare of society Fulfillment of responsibilities towards customers, suppliers etc. Leadership in R&D. Effective utilization of funds

- 36. Interface of Financial Mgt with other functional areas of Mgt • Finance and Production • Finance and Marketing • Finance and Personnel ( Human resource) • Finance and Research & Development

- 37. Finance and Production • Finance is the basis of production and is needed at every stage of production • Planning & preparation of project report • Acquiring raw materails, plant & machinery, tools & spares, technological know how etc. • Hold stocks of RM, WIP and FG .

- 38. Finance and Marketing • Finance is needed in all vital areas of marketing such as • Sales promotion & Advertising • Introduction of new products, diversification of existing lines to satisfy customers changing needs. • Physical distribution of goods.

- 39. Finance and Personnel ( Human resource) • Finance in personnel is required for • Recruitment • Selection • Training • Promotion Schemes.

- 40. FINANCE AND RESEARCH & DEVELOPMENT • Finance in R& D is used for • Innovation • Technological up gradation • To meet and cater the demands of changing needs & preferences of customers • To stay competitive

- 41. Functional Areas of Finance • Personal Finance • Corporate Finance • Public Finance

- 42. Functional Areas of Finance • Personal Finance ▫ Financial Position ▫ Adequate Protection ▫ Tax Planning ▫ Investment and Accumulation Goals ▫ Retirement Planning ▫ Estate Planning

- 43. Functional Areas of Finance • Corporate Finance ▫ Balancing Risk and Profitability ▫ Maximizing Entity’s Wealth and Stock Value ▫ Managing the Working Capital ▫ Measure the Performance of Portfolio

- 44. Functional Areas of Finance • Public Finance ▫ Related to Sovereign States & its entities ▫ Identification of required expenditure ▫ Source of that entities revenue ▫ Debt Issuance for Public Works Projects

- 45. Agency problem • In corporate finance, the agency problem usually refers to a conflict of interest between a company's management and the company's stockholders. The manager, acting as the agent for the shareholders, or principals, is supposed to make decisions that will maximize shareholder wealth

- 46. Thank You References: Principles of Corporate Finance (Brealy, Myers & Alen) MIT OCW – Finance Theory 1 Financial Management – I M Pandey Financial Management M Y Khan