caiibfmwctlmoduled_contd2.pm, KnK:nK;kpt

- 1. Presentation on Working Capital By M.P. DEIVIKARAN

- 2. Working capital Introduction • Working capital typically means the firm’s holding of current or short-term assets such as cash, receivables, inventory and marketable securities. • These items are also referred to as circulating capital • Corporate executives devote a considerable amount of attention to the management of working capital.

- 3. Definition of Working Capital Definition of Working Capital Working Capital refers to that part of the Working Capital refers to that part of the firm’s capital, which is required for financing firm’s capital, which is required for financing short-term or current assets such a cash short-term or current assets such a cash marketable securities, debtors and marketable securities, debtors and inventories. Funds thus, invested in current inventories. Funds thus, invested in current assets keep revolving fast and are assets keep revolving fast and are constantly converted into cash and this constantly converted into cash and this cash flow out again in exchange for other cash flow out again in exchange for other current assets. Working Capital is also current assets. Working Capital is also known as known as revolving or circulating capital or revolving or circulating capital or short-term capital. short-term capital.

- 4. Concept of working capital • There are two possible interpretations of working capital concept: 1. Balance sheet concept 2. Operating cycle concept Balance sheet concept There are two interpretations of working capital under the balance sheet concept. a. Excess of current assets over current liabilities b. gross or total current assets.

- 5. • Excess of current assets over current liabilities are called the net working capital or net current assets. • Working capital is really what a part of long term finance is locked in and used for supporting current activities. • The balance sheet definition of working capital is meaningful only as an indication of the firm’s current solvency in repaying its creditors. • When firms speak of shortage of working capital they in fact possibly imply scarcity of cash resources. • In fund flow analysis an increase in working capital, as conventionally defined, represents employment or application of funds.

- 6. • Operating cycle concept • A company’s operating cycle typically consists of three primary activities: – Purchasing resources, – Producing the product and – Distributing (selling) the product. These activities create funds flows that are both unsynchronized and uncertain. Unsynchronized because cash disbursements (for example, payments for resource purchases) usually take place before cash receipts (for example collection of receivables). They are uncertain because future sales and costs, which generate the respective receipts and disbursements, cannot be forecasted with complete accuracy.

- 7. “ “ circulating capital means current assets of circulating capital means current assets of a company that are changed in the ordinary a company that are changed in the ordinary course of business from one form to course of business from one form to another, as for example, from cash to another, as for example, from cash to inventories, inventories to receivables, inventories, inventories to receivables, receivable to cash” receivable to cash” …… ……Genestenbreg Genestenbreg

- 8. • The firm has to maintain cash balance to pay the bills as they come due. • In addition, the company must invest in inventories to fill customer orders promptly. • And finally, the company invests in accounts receivable to extend credit to customers. • Operating cycle is equal to the length of inventory and receivable conversion periods.

- 9. TYPES OF WORKING CAPITAL WORKING CAPITAL BASIS OF CONCEPT BASIS OF TIME Gross Working Capital Net Working Capital Permanent / Fixed WC Temporary / Variable WC Regular WC Reserve WC Special WC Seasonal WC

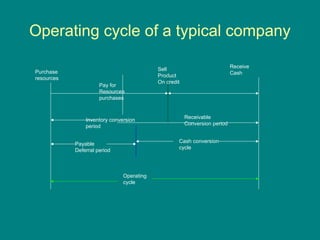

- 10. Operating cycle of a typical company Payable Deferral period Inventory conversion period Cash conversion cycle Operating cycle Pay for Resources purchases Receive Cash Purchase resources Sell Product On credit Receivable Conversion period

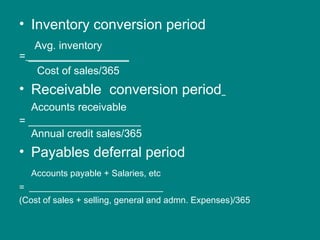

- 11. • Inventory conversion period Avg. inventory = _________________ Cost of sales/365 • Receivable conversion period Accounts receivable = ___________________ Annual credit sales/365 • Payables deferral period Accounts payable + Salaries, etc = ___________________________ (Cost of sales + selling, general and admn. Expenses)/365

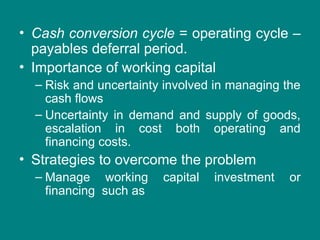

- 12. • Cash conversion cycle = operating cycle – payables deferral period. • Importance of working capital – Risk and uncertainty involved in managing the cash flows – Uncertainty in demand and supply of goods, escalation in cost both operating and financing costs. • Strategies to overcome the problem – Manage working capital investment or financing such as

- 13. – Holding additional cash balances beyond expected needs – Holding a reserve of short term marketable securities – Arrange for availability of additional short-term borrowing capacity – One of the ways to address the problem of fixed set-up cost may be to hold inventory. – One or combination of the above strategies will target the problem • Working capital cycle is the life-blood of the firm

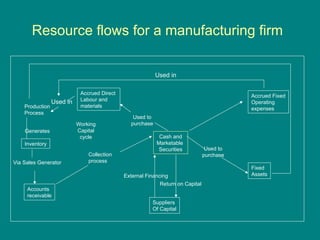

- 14. Resource flows for a manufacturing firm Fixed Assets Production Process Generates Inventory Via Sales Generator Accounts receivable Used in Accrued Direct Labour and materials Accrued Fixed Operating expenses Cash and Marketable Securities Suppliers Of Capital External Financing Return on Capital Collection process Used to purchase Used to purchase Used in Working Capital cycle

- 15. Working capital investment • The size and nature of investment in current assets is a function of different factors such as type of products manufactured, the length of operating cycle, the sales level, inventory policies, unexpected demand and unanticipated delays in obtaining new inventories, credit policies and current assets.

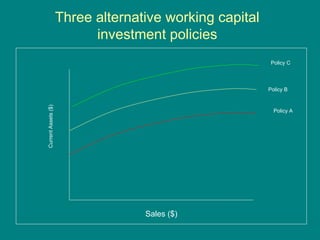

- 16. Three alternative working capital investment policies Sales ($) Current Assets ($) Policy C Policy A Policy B

- 17. • Policy C represents conservative approach • Policy A represents aggressive approach • Policy B represents a moderate approach • Optimal level of working capital investment • Risk of long-term versus short-term debt

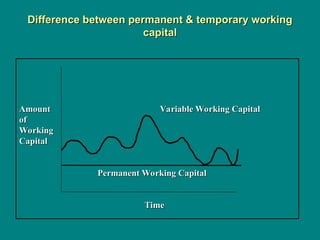

- 18. Difference between permanent & temporary working Difference between permanent & temporary working capital capital Amount Variable Working Capital Amount Variable Working Capital of of Working Working Capital Capital Permanent Working Capital Permanent Working Capital Time Time

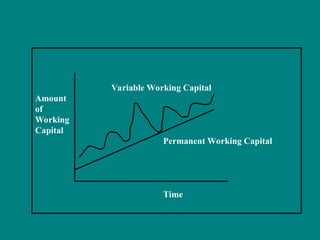

- 19. Variable Working Capital Amount of Working Capital Permanent Working Capital Time

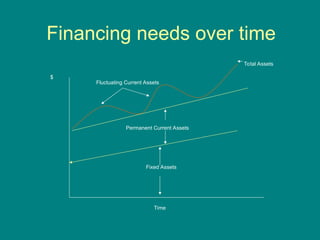

- 20. Financing needs over time Fixed Assets Permanent Current Assets Total Assets Fluctuating Current Assets Time $

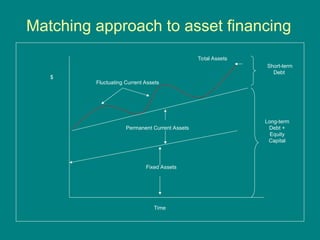

- 21. Matching approach to asset financing Fixed Assets Permanent Current Assets Total Assets Fluctuating Current Assets Time $ Short-term Debt Long-term Debt + Equity Capital

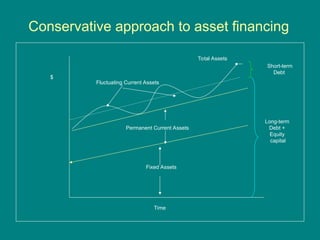

- 22. Conservative approach to asset financing Fixed Assets Permanent Current Assets Total Assets Fluctuating Current Assets Time $ Short-term Debt Long-term Debt + Equity capital

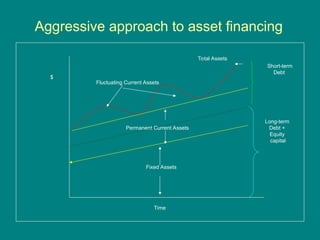

- 23. Aggressive approach to asset financing Fixed Assets Permanent Current Assets Total Assets Fluctuating Current Assets Time $ Short-term Debt Long-term Debt + Equity capital

- 24. Working capital investment and financing policies • wc-f-i-p.doc

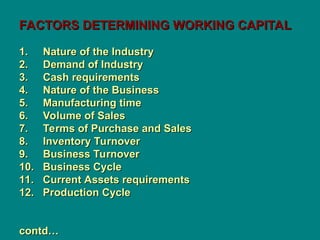

- 25. FACTORS DETERMINING WORKING CAPITAL FACTORS DETERMINING WORKING CAPITAL 1. Nature of the Industry 1. Nature of the Industry 2. Demand of Industry 2. Demand of Industry 3. Cash requirements 3. Cash requirements 4. Nature of the Business 4. Nature of the Business 5. Manufacturing time 5. Manufacturing time 6. Volume of Sales 6. Volume of Sales 7. Terms of Purchase and Sales 7. Terms of Purchase and Sales 8. Inventory Turnover 8. Inventory Turnover 9. Business Turnover 9. Business Turnover 10. Business Cycle 10. Business Cycle 11. Current Assets requirements 11. Current Assets requirements 12. Production Cycle 12. Production Cycle contd… contd…

- 26. Working Capital Determinants (Contd…) Working Capital Determinants (Contd…) 13. Credit control 13. Credit control 14. Inflation or Price level changes 14. Inflation or Price level changes 15. Profit planning and control 15. Profit planning and control 16. Repayment ability 16. Repayment ability 17. Cash reserves 17. Cash reserves 18. Operation efficiency 18. Operation efficiency 19. Change in Technology 19. Change in Technology 20. Firm’s finance and dividend policy 20. Firm’s finance and dividend policy 21. Attitude towards Risk 21. Attitude towards Risk

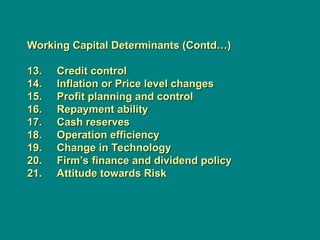

- 27. EXCESS OR INADEQUATE WORKING CAPITAL EXCESS OR INADEQUATE WORKING CAPITAL Every business concern should have adequate Every business concern should have adequate working capital to run its business operations. It working capital to run its business operations. It should have should have neither redundant or excess neither redundant or excess working capital nor inadequate or shortage of working capital nor inadequate or shortage of working capital. working capital. Both excess as well as shortage of working Both excess as well as shortage of working capital situations are bad for any business. capital situations are bad for any business. However, out of the two, inadequacy or shortage However, out of the two, inadequacy or shortage of working capital is more dangerous from the of working capital is more dangerous from the point of view of the firm. point of view of the firm.

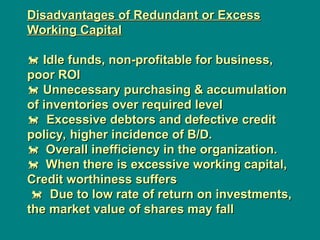

- 28. Disadvantages of Redundant or Excess Disadvantages of Redundant or Excess Working Capital Working Capital Idle funds, non-profitable for business, Idle funds, non-profitable for business, poor ROI poor ROI Unnecessary purchasing & accumulation Unnecessary purchasing & accumulation of inventories over required level of inventories over required level Excessive debtors and defective credit Excessive debtors and defective credit policy, higher incidence of B/D. policy, higher incidence of B/D. Overall inefficiency in the organization. Overall inefficiency in the organization. When there is excessive working capital, When there is excessive working capital, Credit worthiness suffers Credit worthiness suffers Due to low rate of return on investments, Due to low rate of return on investments, the market value of shares may fall the market value of shares may fall

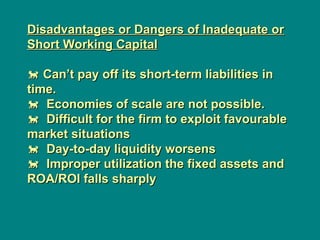

- 29. Disadvantages or Dangers of Inadequate or Disadvantages or Dangers of Inadequate or Short Working Capital Short Working Capital Can’t pay off its short-term liabilities in Can’t pay off its short-term liabilities in time. time. Economies of scale are not possible. Economies of scale are not possible. Difficult for the firm to exploit favourable Difficult for the firm to exploit favourable market situations market situations Day-to-day liquidity worsens Day-to-day liquidity worsens Improper utilization the fixed assets and Improper utilization the fixed assets and ROA/ROI falls sharply ROA/ROI falls sharply

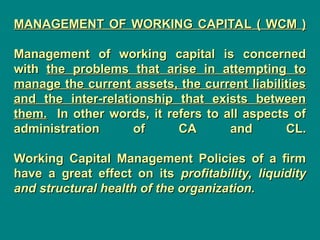

- 30. MANAGEMENT OF WORKING CAPITAL ( WCM ) MANAGEMENT OF WORKING CAPITAL ( WCM ) Management of working capital is concerned Management of working capital is concerned with with the problems that arise in attempting to the problems that arise in attempting to manage the current assets, the current liabilities manage the current assets, the current liabilities and the inter-relationship that exists between and the inter-relationship that exists between them. them. In other words, it refers to all aspects of In other words, it refers to all aspects of administration of CA and CL. administration of CA and CL. Working Capital Management Policies of a firm Working Capital Management Policies of a firm have a great effect on its have a great effect on its profitability, liquidity profitability, liquidity and structural health of the organization. and structural health of the organization.

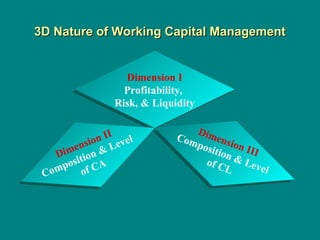

- 31. 3D Nature of Working Capital Management 3D Nature of Working Capital Management Dimension I Profitability, Risk, & Liquidity Dimension II Composition & Level of CA Dimension III Composition & Level of CL

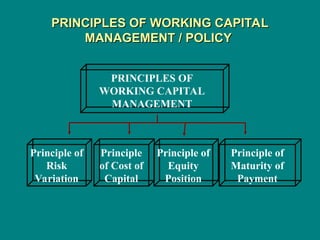

- 32. PRINCIPLES OF WORKING CAPITAL PRINCIPLES OF WORKING CAPITAL MANAGEMENT / POLICY MANAGEMENT / POLICY PRINCIPLES OF WORKING CAPITAL MANAGEMENT Principle of Risk Variation Principle of Cost of Capital Principle of Equity Position Principle of Maturity of Payment

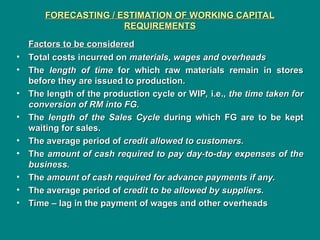

- 33. FORECASTING / ESTIMATION OF WORKING CAPITAL FORECASTING / ESTIMATION OF WORKING CAPITAL REQUIREMENTS REQUIREMENTS Factors to be considered Factors to be considered • Total costs incurred on Total costs incurred on materials, wages and overheads materials, wages and overheads • The The length of time length of time for which raw materials remain in stores for which raw materials remain in stores before they are issued to production. before they are issued to production. • The length of the production cycle or WIP, i.e., The length of the production cycle or WIP, i.e., the time taken for the time taken for conversion of RM into FG. conversion of RM into FG. • The The length of the Sales Cycle length of the Sales Cycle during which FG are to be kept during which FG are to be kept waiting for sales. waiting for sales. • The average period of The average period of credit allowed to customers. credit allowed to customers. • The The amount of cash required to pay day-to-day expenses of the amount of cash required to pay day-to-day expenses of the business. business. • The The amount of cash required for advance payments if any. amount of cash required for advance payments if any. • The average period of The average period of credit to be allowed by suppliers. credit to be allowed by suppliers. • Time – lag in the payment of wages and other overheads Time – lag in the payment of wages and other overheads

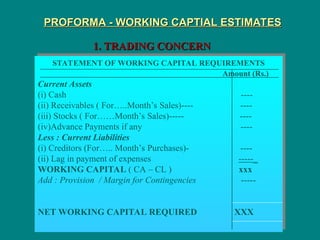

- 34. PROFORMA - WORKING CAPTIAL ESTIMATES PROFORMA - WORKING CAPTIAL ESTIMATES 1. TRADING CONCERN 1. TRADING CONCERN STATEMENT OF WORKING CAPITAL REQUIREMENTS Amount (Rs.) Current Assets (i) Cash ---- (ii) Receivables ( For…..Month’s Sales)---- ---- (iii) Stocks ( For……Month’s Sales)----- ---- (iv)Advance Payments if any ---- Less : Current Liabilities (i) Creditors (For….. Month’s Purchases)- ---- (ii) Lag in payment of expenses -----_ WORKING CAPITAL ( CA – CL ) xxx Add : Provision / Margin for Contingencies ----- NET WORKING CAPITAL REQUIRED XXX

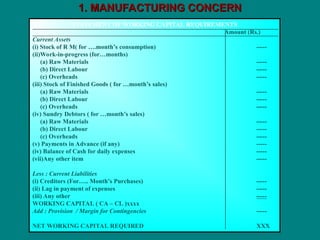

- 35. 1. MANUFACTURING CONCERN 1. MANUFACTURING CONCERN STATEMENT OF WORKING CAPITAL REQUIREMENTS Amount (Rs.) Current Assets (i) Stock of R M( for ….month’s consumption) ----- (ii)Work-in-progress (for…months) (a) Raw Materials ----- (b) Direct Labour ----- (c) Overheads ----- (iii) Stock of Finished Goods ( for …month’s sales) (a) Raw Materials ----- (b) Direct Labour ----- (c) Overheads ----- (iv) Sundry Debtors ( for …month’s sales) (a) Raw Materials ----- (b) Direct Labour ----- (c) Overheads ----- (v) Payments in Advance (if any) ----- (iv) Balance of Cash for daily expenses ----- (vii)Any other item ----- Less : Current Liabilities (i) Creditors (For….. Month’s Purchases) ----- (ii) Lag in payment of expenses ----- (iii) Any other ----- WORKING CAPITAL ( CA – CL )xxxx Add : Provision / Margin for Contingencies ----- NET WORKING CAPITAL REQUIRED XXX

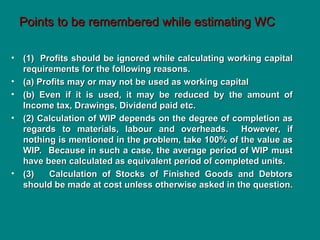

- 36. Points to be remembered while estimating WC Points to be remembered while estimating WC • (1) Profits should be ignored while calculating working capital (1) Profits should be ignored while calculating working capital requirements for the following reasons. requirements for the following reasons. • (a) Profits may or may not be used as working capital (a) Profits may or may not be used as working capital • (b) Even if it is used, it may be reduced by the amount of (b) Even if it is used, it may be reduced by the amount of Income tax, Drawings, Dividend paid etc. Income tax, Drawings, Dividend paid etc. • (2) Calculation of WIP depends on the degree of completion as (2) Calculation of WIP depends on the degree of completion as regards to materials, labour and overheads. However, if regards to materials, labour and overheads. However, if nothing is mentioned in the problem, take 100% of the value as nothing is mentioned in the problem, take 100% of the value as WIP. Because in such a case, the average period of WIP must WIP. Because in such a case, the average period of WIP must have been calculated as equivalent period of completed units. have been calculated as equivalent period of completed units. • (3) Calculation of Stocks of Finished Goods and Debtors (3) Calculation of Stocks of Finished Goods and Debtors should be made at cost unless otherwise asked in the question. should be made at cost unless otherwise asked in the question.

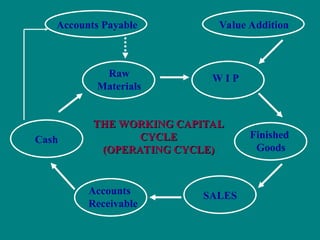

- 37. THE WORKING CAPITAL THE WORKING CAPITAL CYCLE CYCLE (OPERATING CYCLE) (OPERATING CYCLE) Accounts Payable Cash Raw Materials W I P Finished Goods Value Addition Accounts Receivable SALES

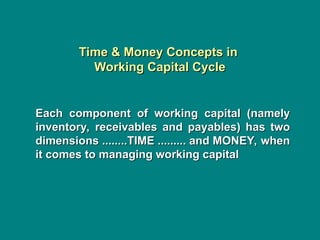

- 38. Time & Money Concepts in Time & Money Concepts in Working Capital Cycle Working Capital Cycle Each component of working capital (namely Each component of working capital (namely inventory, receivables and payables) has two inventory, receivables and payables) has two dimensions ........TIME ......... and MONEY, when dimensions ........TIME ......... and MONEY, when it comes to managing working capital it comes to managing working capital

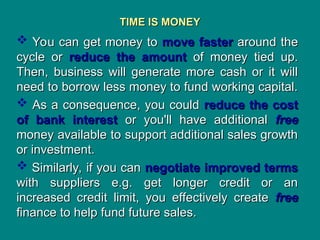

- 39. TIME IS MONEY TIME IS MONEY You can get money to You can get money to move faster move faster around the around the cycle or cycle or reduce the amount reduce the amount of money tied up. of money tied up. Then, business will generate more cash or it will Then, business will generate more cash or it will need to borrow less money to fund working capital. need to borrow less money to fund working capital. As a consequence, you could As a consequence, you could reduce the cost reduce the cost of bank interest of bank interest or you'll have additional or you'll have additional free free money available to support additional sales growth money available to support additional sales growth or investment. or investment. Similarly, if you can Similarly, if you can negotiate improved terms negotiate improved terms with suppliers e.g. get longer credit or an with suppliers e.g. get longer credit or an increased credit limit, you effectively create increased credit limit, you effectively create free free finance to help fund future sales. finance to help fund future sales.

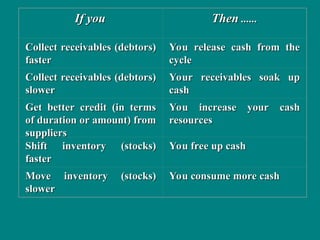

- 40. If you If you Then Then ...... ...... Collect receivables (debtors) Collect receivables (debtors) faster faster You release cash from the You release cash from the cycle cycle Collect receivables (debtors) Collect receivables (debtors) slower slower Your receivables soak up Your receivables soak up cash cash Get better credit (in terms Get better credit (in terms of duration or amount) from of duration or amount) from suppliers suppliers You increase your cash You increase your cash resources resources Shift inventory (stocks) Shift inventory (stocks) faster faster You free up cash You free up cash Move inventory (stocks) Move inventory (stocks) slower slower You consume more cash You consume more cash

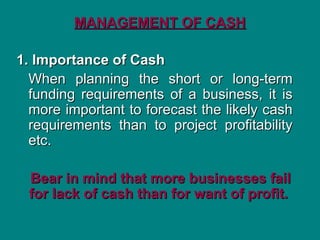

- 41. MANAGEMENT OF CASH MANAGEMENT OF CASH 1. Importance of Cash 1. Importance of Cash When planning the short or long-term When planning the short or long-term funding requirements of a business, it is funding requirements of a business, it is more important to forecast the likely cash more important to forecast the likely cash requirements than to project profitability requirements than to project profitability etc. etc. Bear in mind that more businesses fail Bear in mind that more businesses fail for lack of cash than for want of profit. for lack of cash than for want of profit.

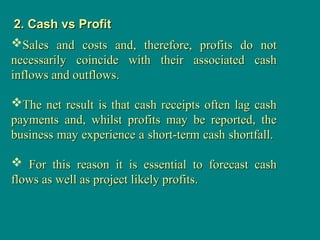

- 42. 2. Cash vs Profit 2. Cash vs Profit Sales and costs and, therefore, profits do not Sales and costs and, therefore, profits do not necessarily coincide with their associated cash necessarily coincide with their associated cash inflows and outflows. inflows and outflows. The net result is that cash receipts often lag cash The net result is that cash receipts often lag cash payments and, whilst profits may be reported, the payments and, whilst profits may be reported, the business may experience a short-term cash shortfall. business may experience a short-term cash shortfall. For this reason it is essential to forecast cash For this reason it is essential to forecast cash flows as well as project likely profits. flows as well as project likely profits.

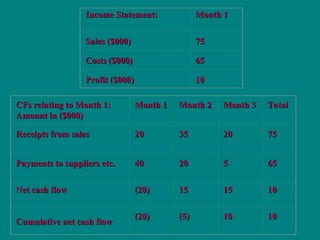

- 43. Income Statement: Income Statement: Month 1 Month 1 Sales ($000) Sales ($000) 75 75 Costs ($000) Costs ($000) 65 65 Profit ($000) Profit ($000) 10 10 CFs relating to Month 1: CFs relating to Month 1: Amount in ($000) Amount in ($000) Month 1 Month 1 Month 2 Month 2 Month 3 Month 3 Total Total Receipts from sales Receipts from sales 20 20 35 35 20 20 75 75 Payments to suppliers etc. Payments to suppliers etc. 40 40 20 20 5 5 65 65 Net cash flow Net cash flow (20) (20) 15 15 15 15 10 10 Cumulative net cash flow Cumulative net cash flow (20) (20) (5) (5) 10 10 10 10

- 44. Calculating Cash Flows Calculating Cash Flows Project cumulative positive net cash flow Project cumulative positive net cash flow over several periods and, conversely, a over several periods and, conversely, a cumulative negative cash flow cumulative negative cash flow Cash flow planning Cash flow planning entails forecasting entails forecasting and tabulating all significant cash inflows and tabulating all significant cash inflows relating to sales, new loans, interest received relating to sales, new loans, interest received etc., and then etc., and then analyzing in detail the timing of analyzing in detail the timing of expected payments expected payments relating to suppliers, relating to suppliers, wages, other expenses, capital expenditure, wages, other expenses, capital expenditure, loan repayments, dividends, tax, interest loan repayments, dividends, tax, interest payments etc. payments etc.

- 45. CASH MANAGEMENT STRATEGIES CASH MANAGEMENT STRATEGIES Cash Planning Cash Planning Cash Forecasts and Budgeting Cash Forecasts and Budgeting Receipts and Disbursements Method Receipts and Disbursements Method Adjusted Net Income Method (Sources and Adjusted Net Income Method (Sources and Uses of Cash) Uses of Cash)

- 46. MANAGING CASH FLOWS MANAGING CASH FLOWS After estimating cash flows, efforts should be After estimating cash flows, efforts should be made to adhere to the estimates of receipts and made to adhere to the estimates of receipts and payments of cash. payments of cash. Cash Management will be successful only if Cash Management will be successful only if cash collections are cash collections are accelerated accelerated and and cash cash payments payments (disbursements), as far as possible, (disbursements), as far as possible, are are delayed delayed. .

- 47. Methods of ACCELERATING CASH INFLOWS Methods of ACCELERATING CASH INFLOWS Prompt payment from customers (Debtors) Prompt payment from customers (Debtors) Quick conversion of payment into cash Quick conversion of payment into cash Decentralized collections Decentralized collections Lock Box System (collecting centers at different locations) Lock Box System (collecting centers at different locations) Methods of DECELERATING CASH OUTFLOWS Methods of DECELERATING CASH OUTFLOWS Paying on the last date Paying on the last date Payment through Cheques and Drafts Payment through Cheques and Drafts Adjusting Payroll Funds (Reducing frequency of payments) Adjusting Payroll Funds (Reducing frequency of payments) Centralization of Payments Centralization of Payments Inter-bank transfers Inter-bank transfers Making use of Float (Difference between balance in Bank Pass Making use of Float (Difference between balance in Bank Pass Book and Bank Column of Cash Book) Book and Bank Column of Cash Book)

- 48. MANAGEMENT OF RECEVABLES MANAGEMENT OF RECEVABLES Receivables ( Sundry Debtors ) result from Receivables ( Sundry Debtors ) result from CREDIT SALES. CREDIT SALES. A concern is required to allow credit in order to A concern is required to allow credit in order to expand its sales volume. expand its sales volume. Receivables contribute a significant portion of Receivables contribute a significant portion of current assets. current assets. But for investment in receivables the firm has to But for investment in receivables the firm has to incur certain costs (opportunity cost and time incur certain costs (opportunity cost and time value ) value ) Further, there is a risk of BAD DEBTS also. Further, there is a risk of BAD DEBTS also. It is, therefore very necessary to have a proper It is, therefore very necessary to have a proper control and management of receivables. control and management of receivables.

- 49. OBJECTIVES OBJECTIVES The objective of Receivables Management The objective of Receivables Management is is to take sound decision as regards to to take sound decision as regards to investment in Debtors. investment in Debtors. In the words of In the words of BOLTON S E., BOLTON S E., the objective of receivables the objective of receivables management is management is “ to promote sales and profits until that “ to promote sales and profits until that point is reached where the return on point is reached where the return on investment in further funding of investment in further funding of receivables is less than the cost of funds receivables is less than the cost of funds raised to finance that additional credit” raised to finance that additional credit”

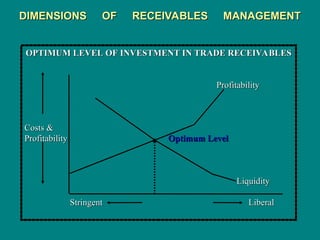

- 50. DIMENSIONS OF RECEIVABLES MANAGEMENT DIMENSIONS OF RECEIVABLES MANAGEMENT OPTIMUM LEVEL OF INVESTMENT IN TRADE RECEIVABLES OPTIMUM LEVEL OF INVESTMENT IN TRADE RECEIVABLES Profitability Profitability Costs & Costs & Profitability Profitability Optimum Level Optimum Level Liquidity Liquidity Stringent Stringent Liberal Liberal

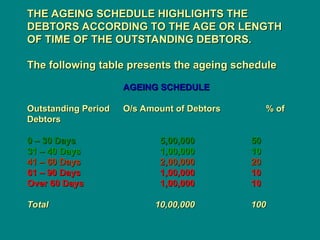

- 51. AVERAGE COLLECTION PERIOD AND AGEING AVERAGE COLLECTION PERIOD AND AGEING SCHEDULE SCHEDULE The collection of BOOK DEBTS can be The collection of BOOK DEBTS can be monitored with the use of average monitored with the use of average collection period and ageing schedule. collection period and ageing schedule. The ACTUAL AVERAGE COLLECTION The ACTUAL AVERAGE COLLECTION PERIOD IS COMPARED WITH THE PERIOD IS COMPARED WITH THE STANDARD COLLECTION PERIOD to STANDARD COLLECTION PERIOD to evaluate the efficiency of collection so that evaluate the efficiency of collection so that necessary corrective action can be initiated necessary corrective action can be initiated and taken. and taken.

- 52. THE AGEING SCHEDULE HIGHLIGHTS THE THE AGEING SCHEDULE HIGHLIGHTS THE DEBTORS ACCORDING TO THE AGE OR LENGTH DEBTORS ACCORDING TO THE AGE OR LENGTH OF TIME OF THE OUTSTANDING DEBTORS. OF TIME OF THE OUTSTANDING DEBTORS. The following table presents the ageing schedule The following table presents the ageing schedule AGEING SCHEDULE AGEING SCHEDULE Outstanding Period Outstanding Period O/s Amount of Debtors O/s Amount of Debtors % of % of Debtors Debtors 0 – 30 Days 0 – 30 Days 5,00,000 5,00,000 50 50 31 – 40 Days 31 – 40 Days 1,00,000 1,00,000 10 10 41 – 60 Days 41 – 60 Days 2,00,000 2,00,000 20 20 61 – 90 Days 61 – 90 Days 1,00,000 1,00,000 10 10 Over 60 Days Over 60 Days 1,00,000 1,00,000 10 10 Total Total 10,00,000 10,00,000 100 100

- 53. Guidelines for Effective Receivables Management Guidelines for Effective Receivables Management 1. 1. Have the right mental attitude to the control of Have the right mental attitude to the control of credit and make sure that it gets the priority it credit and make sure that it gets the priority it deserves. deserves. 2. 2. Establish clear credit practices as a matter of Establish clear credit practices as a matter of company policy. company policy. 3. 3. Make sure that these practices are clearly Make sure that these practices are clearly understood by staff, suppliers and customers. understood by staff, suppliers and customers. 4. 4. Be professional when accepting new accounts, Be professional when accepting new accounts, and especially larger ones. and especially larger ones. 5. 5. Check out each customer thoroughly before you Check out each customer thoroughly before you offer credit. Use credit agencies, bank offer credit. Use credit agencies, bank references, industry sources etc. references, industry sources etc. 6. 6. Establish credit limits for each customer... and Establish credit limits for each customer... and stick to them. stick to them.

- 54. 7. Continuously review these limits when you 7. Continuously review these limits when you suspect suspect tough times are coming or if tough times are coming or if operating in a volatile operating in a volatile sector. sector. 8. Keep very close to your larger customers. 8. Keep very close to your larger customers. 9. Invoice promptly and clearly. 9. Invoice promptly and clearly. 10. Consider charging penalties on overdue 10. Consider charging penalties on overdue accounts. accounts. 11. Consider accepting credit /debit cards as a 11. Consider accepting credit /debit cards as a payment option. payment option. 12. Monitor your debtor balances and ageing 12. Monitor your debtor balances and ageing schedules, and don't let any schedules, and don't let any debts get too large or debts get too large or too old. too old.

- 55. MANAGEMENT OF INVENTORIES MANAGEMENT OF INVENTORIES Managing inventory is a juggling act. Managing inventory is a juggling act. Excessive stocks can place a heavy burden on Excessive stocks can place a heavy burden on the cash resources of a business. the cash resources of a business. Insufficient stocks can result in lost sales, Insufficient stocks can result in lost sales, delays for customers etc. delays for customers etc. INVENTORIES INCLUDE INVENTORIES INCLUDE RAW MATERIALS, WIP & FINISHED RAW MATERIALS, WIP & FINISHED GOODS GOODS

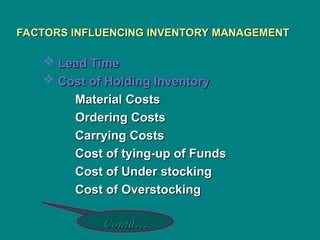

- 56. FACTORS INFLUENCING INVENTORY MANAGEMENT FACTORS INFLUENCING INVENTORY MANAGEMENT Lead Time Lead Time Cost of Holding Inventory Cost of Holding Inventory Material Costs Material Costs Ordering Costs Ordering Costs Carrying Costs Carrying Costs Cost of tying-up of Funds Cost of tying-up of Funds Cost of Under stocking Cost of Under stocking Cost of Overstocking Cost of Overstocking Contd… Contd…

- 57. Stock Levels Stock Levels Reorder Level Reorder Level Maximum Level Maximum Level Minimum Level Minimum Level Safety Level / Danger Level Safety Level / Danger Level Variety Reduction Variety Reduction Materials Planning Materials Planning Service Levels Service Levels Obsolete Inventory and Scrap Obsolete Inventory and Scrap Quantity Discounts Quantity Discounts

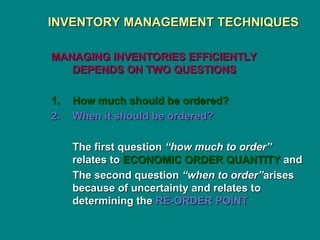

- 58. INVENTORY MANAGEMENT TECHNIQUES INVENTORY MANAGEMENT TECHNIQUES MANAGING INVENTORIES EFFICIENTLY MANAGING INVENTORIES EFFICIENTLY DEPENDS ON TWO QUESTIONS DEPENDS ON TWO QUESTIONS 1. 1. How much should be ordered? How much should be ordered? 2. 2. When it should be ordered? When it should be ordered? The first question The first question “how much to order” “how much to order” relates to relates to ECONOMIC ORDER QUANTITY ECONOMIC ORDER QUANTITY and and The second question The second question “when to order” “when to order”arises arises because of uncertainty and relates to because of uncertainty and relates to determining the determining the RE-ORDER POINT RE-ORDER POINT

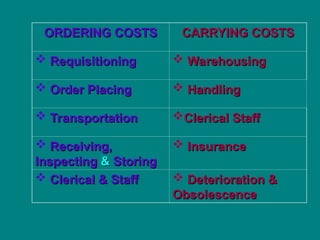

- 59. ECONOMIC ORDER QUANTITY [ EOQ ] ECONOMIC ORDER QUANTITY [ EOQ ] The ordering quantity problems are solved by The ordering quantity problems are solved by the firm by determining the EOQ ( or the the firm by determining the EOQ ( or the Economic Lot Size ) that is the optimum level Economic Lot Size ) that is the optimum level of inventory. of inventory. There are two types of costs involved in this There are two types of costs involved in this model. model. ordering costs ordering costs carrying costs carrying costs The EOQ is that level of inventory which The EOQ is that level of inventory which MINIMIZES the total of ordering and carrying MINIMIZES the total of ordering and carrying

- 60. ORDERING COSTS ORDERING COSTS CARRYING COSTS CARRYING COSTS Requisitioning Requisitioning Warehousing Warehousing Order Placing Order Placing Handling Handling Transportation Transportation Clerical Staff Clerical Staff Receiving, Receiving, Inspecting Inspecting & & Storing Storing Insurance Insurance Clerical & Staff Clerical & Staff Deterioration & Deterioration & Obsolescence Obsolescence

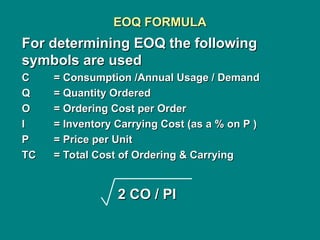

- 61. EOQ FORMULA EOQ FORMULA For determining EOQ the following For determining EOQ the following symbols are used symbols are used C C = Consumption /Annual Usage / Demand = Consumption /Annual Usage / Demand Q Q = Quantity Ordered = Quantity Ordered O O = Ordering Cost per Order = Ordering Cost per Order I I = Inventory Carrying Cost (as a % on P ) = Inventory Carrying Cost (as a % on P ) P P = Price per Unit = Price per Unit TC TC = Total Cost of Ordering & Carrying = Total Cost of Ordering & Carrying 2 CO / PI 2 CO / PI

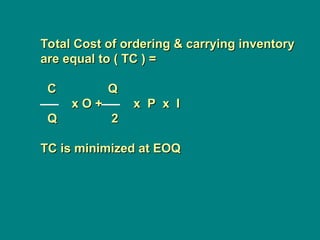

- 62. Total Cost of ordering & carrying inventory Total Cost of ordering & carrying inventory are equal to ( TC ) = are equal to ( TC ) = C C Q Q x O + x P x I x O + x P x I Q Q 2 2 TC is minimized at EOQ TC is minimized at EOQ

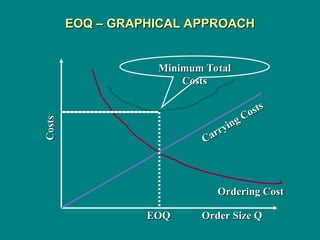

- 63. EOQ – GRAPHICAL APPROACH EOQ – GRAPHICAL APPROACH Costs Costs Carrying Costs Carrying Costs Ordering Cost Ordering Cost Order Size Q Order Size Q EOQ EOQ Minimum Total Minimum Total Costs Costs

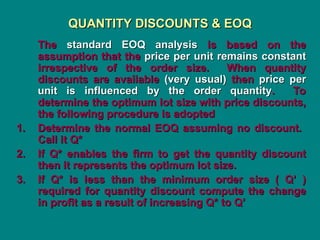

- 64. QUANTITY DISCOUNTS & EOQ QUANTITY DISCOUNTS & EOQ The The standard EOQ analysis standard EOQ analysis is based on the is based on the assumption that the assumption that the price per unit remains constant price per unit remains constant irrespective of the order size. When quantity irrespective of the order size. When quantity discounts are available discounts are available (very usual) (very usual) then then price per price per unit is influenced by the order quantity unit is influenced by the order quantity. To . To determine the optimum lot size with price discounts, determine the optimum lot size with price discounts, the following procedure is adopted the following procedure is adopted 1. 1. Determine the normal EOQ assuming no discount. Determine the normal EOQ assuming no discount. Call it Q* Call it Q* 2. 2. If Q* enables the firm to get the quantity discount If Q* enables the firm to get the quantity discount then it represents the optimum lot size. then it represents the optimum lot size. 3. 3. If Q* is less than the minimum order size ( Q’ ) If Q* is less than the minimum order size ( Q’ ) required for quantity discount compute the change required for quantity discount compute the change in profit as a result of increasing Q* to Q’ in profit as a result of increasing Q* to Q’

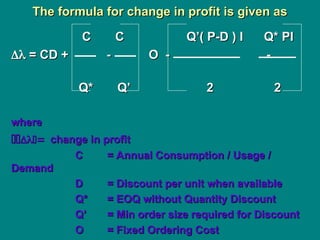

- 65. The formula for change in profit is given as The formula for change in profit is given as C C Q’( P-D ) I Q* PI C C Q’( P-D ) I Q* PI = CD + - O - - = CD + - O - - Q* Q’ 2 Q* Q’ 2 2 2 where where change in profit change in profit C C = Annual Consumption / Usage / = Annual Consumption / Usage / Demand Demand D D = Discount per unit when available = Discount per unit when available Q* Q* = EOQ without Quantity Discount = EOQ without Quantity Discount Q’ Q’ = Min order size required for Discount = Min order size required for Discount O O = Fixed Ordering Cost = Fixed Ordering Cost

- 66. SELECTIVE CONTROL OF INVENTORY SELECTIVE CONTROL OF INVENTORY Different classification methods Different classification methods Classification Classification Basis Basis ABC ABC [Always Better Control ] [Always Better Control ] Value of items consumed Value of items consumed VED VED [ Vital, Essential, [ Vital, Essential, Desirable ] Desirable ] The importance or The importance or criticality criticality FSN FSN [ Fast-moving, Slow- [ Fast-moving, Slow- moving, Non-moving ] moving, Non-moving ] The pace at which the The pace at which the material moves material moves HML HML [ High, Medium, Low ] [ High, Medium, Low ] Unit price of materials Unit price of materials SDE SDE [ Scarce, Difficult, Easy ] [ Scarce, Difficult, Easy ] Procurement Difficulties Procurement Difficulties

- 67. An eye-opener to Inventory Management An eye-opener to Inventory Management For better stock/inventory control, try the following: For better stock/inventory control, try the following: • Review the effectiveness of existing purchasing and Review the effectiveness of existing purchasing and inventory systems. inventory systems. • Know the stock turn for all major items of inventory. Know the stock turn for all major items of inventory. • Apply tight controls to the Apply tight controls to the significant few significant few items and simplify items and simplify controls for the controls for the trivial many trivial many. . • Sell off outdated or slow moving merchandise - it gets more Sell off outdated or slow moving merchandise - it gets more difficult to sell the longer you keep it. difficult to sell the longer you keep it. • Consider having part of your product outsourced to another Consider having part of your product outsourced to another manufacturer rather than make it yourself. manufacturer rather than make it yourself. • Review your security procedures to ensure that no stock "is Review your security procedures to ensure that no stock "is going out the back door !" going out the back door !"

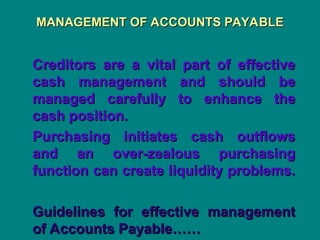

- 68. MANAGEMENT OF ACCOUNTS PAYABLE MANAGEMENT OF ACCOUNTS PAYABLE Creditors are a vital part of effective Creditors are a vital part of effective cash management and should be cash management and should be managed carefully to enhance the managed carefully to enhance the cash position. cash position. Purchasing initiates cash outflows Purchasing initiates cash outflows and an over-zealous purchasing and an over-zealous purchasing function can create liquidity problems. function can create liquidity problems. Guidelines for effective management Guidelines for effective management of Accounts Payable…… of Accounts Payable……

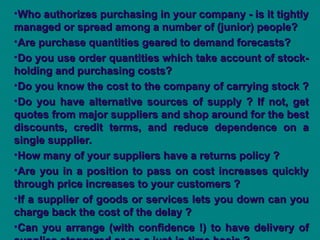

- 69. •Who authorizes purchasing in your company - is it tightly Who authorizes purchasing in your company - is it tightly managed or spread among a number of (junior) people? managed or spread among a number of (junior) people? •Are purchase quantities geared to demand forecasts? Are purchase quantities geared to demand forecasts? •Do you use order quantities which take account of stock- Do you use order quantities which take account of stock- holding and purchasing costs? holding and purchasing costs? •Do you know the cost to the company of carrying stock ? Do you know the cost to the company of carrying stock ? •Do you have alternative sources of supply ? If not, get Do you have alternative sources of supply ? If not, get quotes from major suppliers and shop around for the best quotes from major suppliers and shop around for the best discounts, credit terms, and reduce dependence on a discounts, credit terms, and reduce dependence on a single supplier. single supplier. •How many of your suppliers have a returns policy ? How many of your suppliers have a returns policy ? •Are you in a position to pass on cost increases quickly Are you in a position to pass on cost increases quickly through price increases to your customers ? through price increases to your customers ? •If a supplier of goods or services lets you down can you If a supplier of goods or services lets you down can you charge back the cost of the delay ? charge back the cost of the delay ? •Can you arrange (with confidence !) to have delivery of Can you arrange (with confidence !) to have delivery of

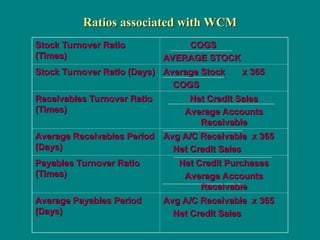

- 70. Ratios associated with WCM Ratios associated with WCM Stock Turnover Ratio Stock Turnover Ratio (Times) (Times) COGS COGS AVERAGE STOCK AVERAGE STOCK Stock Turnover Ratio (Days) Stock Turnover Ratio (Days) Average Stock x 365 Average Stock x 365 COGS COGS Receivables Turnover Ratio Receivables Turnover Ratio (Times) (Times) Net Credit Sales Net Credit Sales Average Accounts Average Accounts Receivable Receivable Average Receivables Period Average Receivables Period (Days) (Days) Avg A/C Receivable x 365 Avg A/C Receivable x 365 Net Credit Sales Net Credit Sales Payables Turnover Ratio Payables Turnover Ratio (Times) (Times) Net Credit Purchases Net Credit Purchases Average Accounts Average Accounts Receivable Receivable Average Payables Period Average Payables Period (Days) (Days) Avg A/C Receivable x 365 Avg A/C Receivable x 365 Net Credit Sales Net Credit Sales

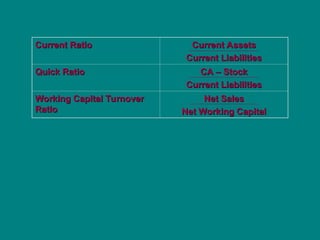

- 71. Current Ratio Current Ratio Current Assets Current Assets Current Liabilities Current Liabilities Quick Ratio Quick Ratio CA – Stock CA – Stock Current Liabilities Current Liabilities Working Capital Turnover Working Capital Turnover Ratio Ratio Net Sales Net Sales Net Working Capital Net Working Capital

![ECONOMIC ORDER QUANTITY [ EOQ ]

ECONOMIC ORDER QUANTITY [ EOQ ]

The ordering quantity problems are solved by

The ordering quantity problems are solved by

the firm by determining the EOQ ( or the

the firm by determining the EOQ ( or the

Economic Lot Size ) that is the optimum level

Economic Lot Size ) that is the optimum level

of inventory.

of inventory.

There are two types of costs involved in this

There are two types of costs involved in this

model.

model.

ordering costs

ordering costs

carrying costs

carrying costs

The EOQ is that level of inventory which

The EOQ is that level of inventory which

MINIMIZES the total of ordering and carrying

MINIMIZES the total of ordering and carrying](https://image.slidesharecdn.com/caiibfmwctlmoduledcontd2-250130132836-f8ce0f5c/85/caiibfmwctlmoduled_contd2-pm-KnK-nK-kpt-59-320.jpg)

![SELECTIVE CONTROL OF INVENTORY

SELECTIVE CONTROL OF INVENTORY

Different classification methods

Different classification methods

Classification

Classification Basis

Basis

ABC

ABC

[Always Better Control ]

[Always Better Control ]

Value of items consumed

Value of items consumed

VED

VED

[ Vital, Essential,

[ Vital, Essential,

Desirable ]

Desirable ]

The importance or

The importance or

criticality

criticality

FSN

FSN

[ Fast-moving, Slow-

[ Fast-moving, Slow-

moving, Non-moving ]

moving, Non-moving ]

The pace at which the

The pace at which the

material moves

material moves

HML

HML

[ High, Medium, Low ]

[ High, Medium, Low ]

Unit price of materials

Unit price of materials

SDE

SDE

[ Scarce, Difficult, Easy ]

[ Scarce, Difficult, Easy ]

Procurement Difficulties

Procurement Difficulties](https://image.slidesharecdn.com/caiibfmwctlmoduledcontd2-250130132836-f8ce0f5c/85/caiibfmwctlmoduled_contd2-pm-KnK-nK-kpt-66-320.jpg)